Many of the largest international jewellers make it look extremely easy to import jewellery into Australia – providing prices in Aussie dollars, helping you understand what taxes will be due and offering free shipping and returns.

So is it worth it, over buying locally?

The answer: maybe.

In this article, we’ll look at

- Actual costs of importing jewellery into Australia

- Things to be careful of when importing

- When you may want

Cost of importing jewellery into Australia

Price is likely to be the biggest factor in deciding whether you will or won’t import into Aus – after all, if it wasn’t cheaper, then why would you bother?

When making your decision, it’s important to understand that the price when buying overseas can vary hugely, depending on the relative strength of the economies at the time you’re looking to buy.

A big factor that will affect the price is the current exchange rate between the country you are importing from and the Aussie dollar.

The US dollar has varied about 15% in value against AUD over the last 12 months, with the British Pound changing a similar amount.

These changes can happen quickly, which means that what seemed to be a bargain recently, suddenly is hundreds, or even thousands of dollars more expensive.

Of course, the opposite can also be true, and a weakening Aussie dollar can mean the buying from overseas suddenly becomes much more tempting.

The other thing to consider is the actual total, which is likely to be quite different from the price you see on an overseas retailer’s website. As well as the price listed, there will also be:

- Australian GST, which most overseas retailers don’t include in their prices online

- Import duty

- Shipping fees

- Insurance

- Potentially further costs if you need to ship the item back to them for any reason

Taxes, import duty and other fees

The biggest additional fee that needs to be added to the price of any jewellery you see online from overseas retailers is 10% GST. This is the exact same tax that you would pay if you were buying from a retailer within Aus, but local jewellers almost always include it in the prices listed.

Some overseas retailers are classified as the ‘importer of record’, which means that they will include GST in their price and pay it on your behalf, so it’s always worth reading the policies carefully when comparing prices, both to other overseas retailers and local ones.

The next fee is 5% import duty, which is payable on almost all items that are valued at over A$1,000. There are, however, exceptions. If you are considering importing a diamond ring into Australia from the US, you can actually avoid the 5% import duty fee if you buy a loose diamond.

You can verify this here on the Government website which details the exemptions to duty in the free trade agreement between Australia and the USA – it shows that ‘Diamonds, whether or not worked, but not mounted or set’ have been subject to 0% tariff from January 2016 onwards.

The next fee to consider is the Aussie Govt’s ‘Import processing charge‘, which is charged if import declaration is made. The exact fee will depend on the value of the goods that are being imported, but is likely to be $90 if the jewellery is value at less than $10k and $190 if it’s valued above $10k. You can find out more about the fees here.

Lastly, there is the shipping and insurance fees that may be charged by the retailer themselves. Many overseas retailers do offer free shipping and insurance, but it’s always worth checking. Side-note: insurance is essential when shipping a high-value item overseas, so it’s important to always ensure that you’re covered.

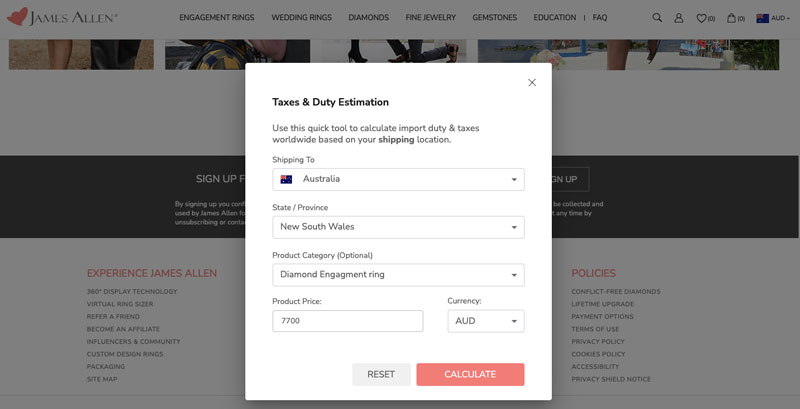

Working out all of these additional costs can be a bit annoying if you’re comparing lots of rings from different retailers, but James Allen have a great sales tax calculator which is definitely worth checking out, whether you’re planning on buying from them or not:

Things to be careful of when importing jewellery into Australia

Even with the additional fees, if the foreign exchange winds are blowing in your direction, then importing jewellery into Aus can make sense financially. Buy buying jewellery isn’t only a financial decision, especially if it’s a purchase like an engagement ring where timings and after-sales service can be important.

Manufacturing and shipping times

If you’re buying an engagement ring overseas, it’s likely that the retailer themselves has to import the diamond to their manufacturing facility, as these are often held by off-shore suppliers.

Creating a diamond ring can sometimes take 2-4 weeks, with shipping and clearing customs adding 1-2 weeks on top of this. While these can all be predicted and planned for, it’s important to bear this in mind.

Warranty and returns:

Most overseas retailers offer good warranty and service policies – in fact, they are often better than local Australian jewellers. The tricky thing is in the timing of them, with some overseas retailers starting to count the days on their ’30 days return policy’ from when the item is shipped.

Make sure to review the service policies carefully to ensure that it works for you.

Adjustments:

Particularly with diamond rings, adjustments are common. If you’re planning on surprising your partner with an engagement ring, even with the best planning. Buying locally will mean that adjustments are usually free, while buying overseas may mean that you need to pay to ship the ring back, even if the adjustment itself is free.